Expert Tips for Sellingan Apartment Building

Master the art of selling your apartment building with proven strategies from industry experts. Learn how to maximize your sale price, attract qualified buyers, and close deals faster with our comprehensive guide covering everything from preparation to closing.

What You'll Learn in This Guide

Preparing Your Apartment Building for Sale

First impressions matter tremendously when selling an apartment building. Proper preparation can significantly increase your property's value and attract more qualified buyers. Here are essential tips for selling an apartment building that focus on preparation and presentation.

Enhance Curb Appeal and First Impressions

The exterior of your apartment building is the first thing potential buyers see, and it sets the tone for their entire evaluation. Investing in curb appeal improvements can yield returns of 100-200% on your investment. Focus on creating a welcoming, well-maintained appearance that suggests the property has been professionally managed and cared for throughout its ownership.

Landscaping and Grounds

Maintain pristine landscaping with fresh mulch, trimmed hedges, and seasonal flowers. Ensure parking lots are clean, striped, and well-lit. Remove any debris, repair cracked pavement, and power wash walkways and building exteriors.

Exterior Maintenance

Address any visible exterior issues including peeling paint, damaged siding, broken windows, or worn roofing. These items signal deferred maintenance to buyers and can significantly impact their offer price or financing ability.

Common Areas

Upgrade common areas including lobbies, hallways, laundry rooms, and amenity spaces. Fresh paint, modern lighting fixtures, and clean flooring make a significant difference in buyer perception and can justify higher asking prices.

Essential Documentation to Prepare

One of the most important tips for selling an apartment building is having comprehensive documentation ready before listing. Organized, detailed records demonstrate professional management and help buyers make confident decisions quickly, leading to faster sales at better prices.

Financial Records

- • Last 3 years of profit and loss statements

- • Current rent roll with lease expiration dates

- • Historical occupancy rates and trends

- • Utility expenses and operating costs

- • Property tax records and assessments

- • Insurance policies and claims history

- • Capital expenditure records

Property Information

- • Complete unit mix and floor plans

- • Property survey and legal description

- • Environmental reports and inspections

- • Roof certification and warranty documents

- • HVAC, plumbing, and electrical system records

- • Recent property appraisals

- • Zoning information and permits

Tenant Documentation

- • Current lease agreements for all units

- • Security deposit records and accounting

- • Tenant payment history and delinquencies

- • Maintenance request logs and responses

- • Tenant turnover rates and reasons

- • Lease renewal rates and trends

- • Any tenant disputes or legal issues

Address Deferred Maintenance Strategically

Among the most valuable tips for selling an apartment building is understanding which repairs to make and which to leave alone. Not all improvements provide equal returns, and some may not be worth the investment if you're selling soon. Focus on repairs that either prevent deal-breakers during inspections or provide strong returns on investment.

High-Priority Repairs (Must Fix)

These issues can kill deals or significantly reduce offers. Address them before listing:

- • Roof leaks or structural damage

- • Code violations or safety hazards

- • Non-functioning HVAC or plumbing systems

- • Electrical problems or outdated panels

- • Foundation issues or water intrusion

Medium-Priority Improvements (Consider ROI)

These improvements can increase value but evaluate cost versus benefit:

- • Unit upgrades in vacant apartments

- • Common area renovations

- • Energy efficiency improvements

- • Amenity additions or upgrades

Low-Priority Items (Usually Skip)

These rarely provide sufficient return when selling:

- • Cosmetic upgrades to occupied units

- • Luxury amenity additions

- • Major landscaping overhauls

- • Premium finishes or materials

Pricing Strategies for Maximum Returns

Setting the right price is one of the most critical tips for selling an apartment building successfully. Price too high and you'll scare away qualified buyers; price too low and you'll leave money on the table. Learn how to determine the optimal asking price that attracts serious investors while maximizing your returns.

Understanding Valuation Methods

Commercial real estate, including apartment buildings, is valued differently than residential properties. Understanding these valuation methods is essential for setting a competitive and realistic asking price. Most buyers will use one or more of these approaches to determine their offer price.

Income Capitalization Approach

The most common method for valuing apartment buildings. This approach divides the property's Net Operating Income (NOI) by the market capitalization rate (cap rate) to determine value.

Formula: Property Value = NOI ÷ Cap Rate

Example: $200,000 NOI ÷ 6% cap rate = $3,333,333 property value

Sales Comparison Approach

Compares your property to similar apartment buildings that have recently sold in your market. Adjustments are made for differences in size, condition, location, and amenities.

Most useful when there are recent comparable sales of similar properties in your area.

Cost Approach

Calculates what it would cost to rebuild the property from scratch, minus depreciation, plus land value. Less commonly used for apartment buildings but helpful for newer properties or unique situations.

Key Factors That Impact Your Apartment Building's Value

Net Operating Income

Your NOI is the single most important factor in determining value. Higher rental income and lower operating expenses directly increase your property's worth. Focus on maximizing NOI before listing by increasing rents to market rates and reducing unnecessary expenses.

Location and Market

Properties in strong rental markets with low vacancy rates, job growth, and population increases command premium prices. Location factors include neighborhood quality, school districts, proximity to employment centers, and local amenities.

Property Condition

Well-maintained properties with updated systems, modern amenities, and minimal deferred maintenance sell for higher prices. Buyers pay premiums for turnkey properties that won't require immediate capital expenditures.

Occupancy Rate

Higher occupancy rates indicate strong demand and stable income, making your property more attractive to buyers. Properties with 90%+ occupancy typically sell faster and at higher prices than those with significant vacancy.

Lease Terms

Long-term leases with quality tenants provide income stability that buyers value. Properties with staggered lease expirations reduce turnover risk and are more attractive than those with many leases expiring simultaneously.

Value-Add Potential

Properties with opportunities for rent increases, unit upgrades, or operational improvements attract investors looking for upside potential. Clearly document these opportunities to justify your asking price.

Strategic Pricing Tactics

Beyond understanding valuation methods, implementing smart pricing tactics is among the most effective tips for selling an apartment building quickly and profitably. Your pricing strategy should consider market conditions, buyer psychology, and your timeline for selling.

Price Slightly Below Market

Pricing 3-5% below comparable properties can generate multiple offers and create competition among buyers, potentially driving the final price above asking. This strategy works best in strong markets with high buyer demand.

Use Psychological Pricing

Price at $2,995,000 instead of $3,000,000. While the difference is minimal, properties priced just below round numbers appear in more search results and feel more negotiable to buyers, generating more interest and showings.

Build in Negotiation Room

Most buyers expect to negotiate. Price 5-10% above your minimum acceptable price to allow room for negotiation while still achieving your target. This makes buyers feel they're getting a deal while you reach your goals.

Consider Market Timing

Spring and fall typically see the most buyer activity for commercial properties. If you're not in a rush, timing your listing for these peak seasons can result in more offers and better prices than listing during slower periods.

Marketing Your Apartment Building Effectively

Effective marketing is crucial among tips for selling an apartment building. Unlike residential properties, apartment buildings require targeted marketing to reach qualified investors and institutional buyers. Learn how to create compelling marketing materials and reach the right audience for your property.

Create a Professional Offering Memorandum

The offering memorandum (OM) is your property's resume and one of the most important marketing tools when selling an apartment building. This comprehensive document provides potential buyers with all the information they need to evaluate your property and make informed decisions. A well-prepared OM demonstrates professionalism and can significantly impact buyer interest and offer quality.

Essential OM Components

- • Executive summary with property highlights

- • Detailed property description and specifications

- • High-quality professional photography

- • Unit mix breakdown and floor plans

- • Current rent roll and lease abstracts

- • 3-year financial performance history

- • Market analysis and demographics

- • Capital improvements and deferred maintenance

- • Proforma projections and value-add opportunities

- • Location maps and area amenities

Pro Tip: Hire a professional designer to create your OM. A polished, visually appealing document signals that you're a serious seller with a quality property, which can justify premium pricing and attract better-qualified buyers.

Multi-Channel Marketing Strategy

One of the key tips for selling an apartment building is using multiple marketing channels to reach different types of buyers. Each channel attracts different investor profiles, so a comprehensive approach maximizes your exposure and increases the likelihood of receiving multiple competitive offers.

Online Platforms

List on major commercial real estate platforms like LoopNet, CoStar, Crexi, and Ten-X to reach active investors searching for properties.

- • LoopNet (largest reach)

- • CoStar (institutional buyers)

- • Crexi (emerging platform)

- • Ten-X (auction option)

Broker Networks

Work with commercial real estate brokers who have established relationships with qualified apartment building investors.

- • Access to buyer databases

- • Off-market opportunities

- • Negotiation expertise

- • Transaction management

Direct Marketing

Target known apartment building investors in your market with personalized outreach and property information.

- • Email campaigns to investors

- • Direct mail to property owners

- • LinkedIn outreach

- • Investment group presentations

Networking Events

Attend real estate investment meetings, conferences, and local investor groups to connect with potential buyers.

- • Local REIA meetings

- • Commercial real estate conferences

- • Industry trade shows

- • Investor networking events

Invest in Professional Photography and Media

High-quality visual content is non-negotiable when marketing apartment buildings. Professional photography and media can increase buyer interest by 60% or more and help your property stand out in crowded online listings. This investment typically costs $1,000-3,000 but can add tens of thousands to your sale price by attracting more buyers and creating stronger first impressions.

Professional Photography

Hire a commercial real estate photographer who understands how to showcase multifamily properties. Include exterior shots from multiple angles, common areas, representative units, and amenities during optimal lighting conditions.

Aerial Drone Footage

Drone photography provides unique perspectives that showcase your property's size, location, and surrounding area. Aerial shots are particularly effective for larger complexes and properties with attractive locations or amenities.

Video Tours

Create professional video tours that allow out-of-state investors to virtually walk through your property. Videos increase engagement and help serious buyers pre-qualify themselves before scheduling in-person showings.

Virtual Tours and 3D Walkthroughs

Matterport or similar 3D tours allow buyers to explore your property remotely at their convenience. This technology is especially valuable for attracting out-of-market investors and reducing unnecessary showings.

Confidentiality and Discretion

An often-overlooked aspect of tips for selling an apartment building is maintaining confidentiality during the marketing process. Improper disclosure can upset tenants, alert competitors, and create unnecessary complications. Implement these strategies to protect your interests while marketing effectively.

Use Blind Listings

Initially market your property without revealing the exact address. Provide general location information and require interested buyers to sign confidentiality agreements before receiving detailed property information and the specific address.

Require NDAs

Have all potential buyers sign Non-Disclosure Agreements before sharing sensitive financial information, tenant details, or operational data. This protects your business information and ensures serious buyer intent.

Communicate with Tenants

Decide when and how to inform tenants about the sale. Many sellers wait until they have a contract to avoid unnecessary concern. When you do notify tenants, reassure them about lease terms and continuity of service.

Negotiation Tactics for Apartment Building Sales

Skilled negotiation is among the most valuable tips for selling an apartment building at the best possible price and terms. Understanding buyer motivations, leverage points, and negotiation strategies can add hundreds of thousands of dollars to your final sale price while ensuring favorable terms.

Understanding Buyer Motivations

Different types of buyers have different priorities and motivations. Recognizing what drives each buyer type allows you to emphasize the aspects of your property that matter most to them and structure deals that meet their needs while maximizing your returns. This understanding is crucial for effective negotiation.

Individual Investors

Priorities: Cash flow, appreciation potential, tax benefits

Negotiation Approach: Emphasize stable income, low maintenance, and value-add opportunities. These buyers often have more flexibility on terms but may need financing contingencies.

Institutional Buyers

Priorities: Market position, portfolio fit, predictable returns

Negotiation Approach: Highlight professional management, strong financials, and market fundamentals. These buyers move quickly but have strict investment criteria.

Value-Add Investors

Priorities: Below-market rents, renovation opportunities, operational improvements

Negotiation Approach: Document upside potential and provide detailed proformas. These buyers may pay premium prices if they see significant value-add opportunities.

1031 Exchange Buyers

Priorities: Timeline certainty, smooth closing, similar or greater value

Negotiation Approach: Offer certainty and flexibility on closing dates. These buyers are often motivated and may pay premiums to meet exchange deadlines.

Key Negotiation Points Beyond Price

While price is important, experienced sellers know that other terms can be equally valuable. These negotiation points can make the difference between a good deal and a great one, and understanding them is essential among tips for selling an apartment building successfully.

Closing Timeline

Negotiate closing dates that work for your situation. If you need time to relocate or complete a 1031 exchange, build that into the contract. Conversely, if a buyer needs a quick close, you can often command a premium price for accommodating their timeline.

Earnest Money Deposit

Require substantial earnest money deposits (typically 1-3% of purchase price) to ensure buyer commitment. Larger deposits indicate serious buyers and provide protection if the deal falls through. Negotiate non-refundable deposits after due diligence for additional security.

Due Diligence Period

Limit due diligence periods to 30-45 days for most transactions. Longer periods tie up your property and create uncertainty. If buyers request extensions, consider requiring additional non-refundable deposits or price increases to compensate for the extended timeline.

Contingencies

Minimize contingencies whenever possible. Financing contingencies, inspection contingencies, and sale of other property contingencies all create risk. Cash offers or buyers with proof of funds are more valuable even at slightly lower prices due to certainty of closing.

Repair Credits and Concessions

Be strategic about repair credits. Sometimes it's better to complete repairs yourself to control costs and quality. Other times, offering credits is more efficient. Negotiate caps on repair obligations and avoid open-ended commitments to fix all inspection items.

Seller Financing

Consider offering seller financing to attract more buyers and potentially command higher prices. This can be especially effective in tight lending markets. Ensure proper security, adequate down payments, and favorable interest rates that compensate for the risk.

Handling Multiple Offers

Receiving multiple offers is the ideal scenario when selling an apartment building. However, managing multiple offers requires strategy and finesse to maximize your outcome. These tips for selling an apartment building in competitive situations can help you leverage multiple offers into the best possible deal.

Create Competition

When you receive multiple offers, let buyers know (without revealing specific terms) that you have competing interest. Set a deadline for best and final offers to create urgency and encourage buyers to submit their strongest terms.

Evaluate Total Package

Don't automatically accept the highest price. Consider the entire offer including contingencies, closing timeline, earnest money, buyer qualifications, and likelihood of closing. A slightly lower all-cash offer with no contingencies may be more valuable than a higher financed offer.

Negotiate with Top Candidates

After reviewing all offers, select your top 2-3 candidates and negotiate with each to improve terms. You can use competing offers as leverage to push for better prices, shorter contingency periods, or more favorable terms without revealing specific details from other offers.

Keep Backup Offers

Even after accepting an offer, keep backup offers in position until you close. If your primary buyer fails to perform or backs out during due diligence, having backup offers ready prevents starting over and maintains your negotiating position.

Legal Considerations When Selling Apartment Buildings

Understanding legal requirements and protecting yourself legally are critical tips for selling an apartment building. Commercial real estate transactions involve complex legal issues that can derail deals or create liability if not handled properly. Work with experienced professionals and understand these key legal considerations.

Essential Legal Documentation

Proper legal documentation protects both parties and ensures smooth transactions. Missing or incomplete documentation is one of the most common reasons apartment building sales fall through or result in post-closing disputes. Prepare these documents carefully with qualified legal counsel.

Purchase and Sale Agreement

The PSA is the foundation of your transaction. It should clearly define purchase price, earnest money, contingencies, closing date, included personal property, prorations, and all other material terms. Use attorney-drafted agreements specific to commercial real estate, not residential forms.

Title Insurance and Survey

Obtain title insurance to protect against title defects and provide a current survey showing property boundaries, easements, and encroachments. Address any title issues before closing to avoid delays or complications.

Lease Assignment Documents

Prepare proper lease assignment documents transferring all tenant leases to the buyer. Include estoppel certificates from tenants confirming lease terms, security deposits, and any agreements or modifications.

Disclosure Documents

Provide comprehensive disclosures about property condition, known defects, environmental issues, legal disputes, code violations, and material facts. Proper disclosure protects you from post-closing liability claims.

Tenant Rights and Lease Transfers

One of the most important legal tips for selling an apartment building involves properly handling tenant rights and lease transfers. Tenants have legal protections that must be respected, and improper handling can create liability or derail your sale.

Tenant Notifications

Most states require notifying tenants of ownership changes. Provide written notice including new owner information, where to send rent, and security deposit transfer details.

- • Check state-specific notification requirements

- • Provide notice in writing with proper timing

- • Include new owner contact information

- • Document all tenant communications

Security Deposit Transfers

Security deposits must be properly transferred to the new owner with complete accounting. Failure to handle deposits correctly can create liability for both parties.

- • Provide detailed security deposit accounting

- • Transfer actual funds at closing

- • Document condition of units at transfer

- • Notify tenants of deposit transfer

Lease Obligations

All existing lease terms remain in effect after sale. The new owner assumes all obligations including maintenance responsibilities, renewal options, and any special agreements.

- • Provide complete copies of all leases

- • Disclose any lease modifications or side agreements

- • Transfer maintenance and service contracts

- • Document any tenant disputes or issues

Environmental Compliance and Liability

Environmental issues can create significant liability and are among the most serious legal considerations when selling apartment buildings. Understanding and addressing environmental concerns protects you from future liability and prevents deal complications.

Phase I Environmental Assessment

Most buyers require Phase I environmental assessments to identify potential contamination or environmental hazards. Consider obtaining this report proactively to address any issues before listing and demonstrate transparency to buyers.

Common Environmental Concerns

- • Asbestos in older buildings (pre-1980)

- • Lead-based paint in units built before 1978

- • Underground storage tanks (current or historical)

- • Mold or water damage issues

- • Soil or groundwater contamination

- • Radon in certain geographic areas

Liability Protection

Obtain environmental insurance or negotiate liability caps in your purchase agreement. Proper disclosure and documentation of environmental conditions provides important legal protection against future claims.

Tax Implications and Strategies

Understanding tax implications is one of the most financially important tips for selling an apartment building. Without proper planning, you could lose 30-40% of your profits to taxes. Learn strategies to minimize tax liability and maximize your after-tax proceeds from the sale.

Understanding Capital Gains Tax

When you sell an apartment building for more than your adjusted cost basis, you'll owe capital gains tax on the profit. The amount depends on how long you've owned the property and your income tax bracket. Understanding these taxes is essential for planning your sale strategy.

Long-Term Capital Gains

Properties held longer than one year qualify for long-term capital gains rates, which are significantly lower than ordinary income rates. Current federal rates are 0%, 15%, or 20% depending on your income level.

Example: If you're in the 20% capital gains bracket and sell for a $500,000 profit, you'd owe approximately $100,000 in federal capital gains tax, plus state taxes.

Depreciation Recapture

The IRS requires you to "recapture" depreciation deductions you've taken over the years. This recaptured depreciation is taxed at a maximum rate of 25%, which is higher than long-term capital gains rates.

Important: Even if you didn't claim depreciation deductions, the IRS assumes you did and will still require recapture. Always claim depreciation to get the tax benefit.

State and Local Taxes

Don't forget state and local capital gains taxes, which vary by location. Some states have no capital gains tax, while others tax gains as ordinary income at rates up to 13%. Factor these into your net proceeds calculations.

1031 Exchange: Defer Capital Gains Tax

The 1031 exchange is one of the most powerful tax-deferral strategies and among the most valuable tips for selling an apartment building. By reinvesting proceeds into another investment property, you can defer all capital gains and depreciation recapture taxes indefinitely.

1031 Exchange Requirements

- Like-Kind Property: Must exchange for another investment property (apartment buildings, commercial buildings, land, etc.)

- 45-Day Identification: Identify replacement properties within 45 days of selling your property

- 180-Day Purchase: Complete purchase of replacement property within 180 days of sale

- Equal or Greater Value: Replacement property must be equal or greater value to defer all taxes

- Qualified Intermediary: Must use a qualified intermediary to hold proceeds during exchange

- No Receipt of Funds: Cannot receive sale proceeds directly or the exchange is disqualified

1031 Exchange Strategies

Delayed Exchange (Most Common)

Sell your property first, then identify and purchase replacement property within the required timeframes. This is the standard 1031 exchange structure.

Reverse Exchange

Purchase replacement property before selling your current property. Useful when you find the perfect replacement property but haven't sold yet.

Improvement Exchange

Use exchange funds to improve the replacement property before taking title. Allows you to add value while deferring taxes.

Delaware Statutory Trust (DST)

Invest in fractional ownership of institutional-grade properties. Provides passive income and simplifies property management while completing your 1031 exchange.

Important 1031 Exchange Considerations

While 1031 exchanges offer powerful tax benefits, they require careful planning and strict adherence to IRS rules. Work with experienced qualified intermediaries and tax advisors to ensure compliance and maximize benefits.

- • Start planning your exchange before listing your property

- • Identify multiple backup replacement properties in case deals fall through

- • Ensure your purchase contract allows for 1031 exchange assignment

- • Never receive or control sale proceeds during the exchange period

- • Consider market conditions and availability of suitable replacement properties

Additional Tax Planning Strategies

Beyond 1031 exchanges, several other strategies can help minimize taxes when selling apartment buildings. These tips for selling an apartment building with tax efficiency can save significant money and should be discussed with qualified tax professionals.

Installment Sales

Structure the sale as an installment sale where you receive payments over multiple years. This spreads your capital gains tax liability across multiple tax years, potentially keeping you in lower tax brackets and reducing overall tax burden.

Opportunity Zone Investment

Invest capital gains into Qualified Opportunity Zone funds within 180 days of sale. This defers taxes until 2026 and can eliminate taxes on appreciation of the Opportunity Zone investment if held for 10+ years.

Cost Segregation Before Sale

Conduct cost segregation studies before selling to accelerate depreciation deductions. While this increases depreciation recapture, it can provide valuable deductions in high-income years before the sale.

Charitable Remainder Trust

Donate your property to a charitable remainder trust, which sells it tax-free and pays you income for life. You get immediate tax deductions, avoid capital gains tax, and support charitable causes while maintaining income.

Timing Your Sale for Maximum Value

Timing is one of the most underrated tips for selling an apartment building. Market conditions, seasonal factors, and economic cycles all impact buyer demand and pricing. Understanding when to sell can mean the difference between a good sale and an exceptional one.

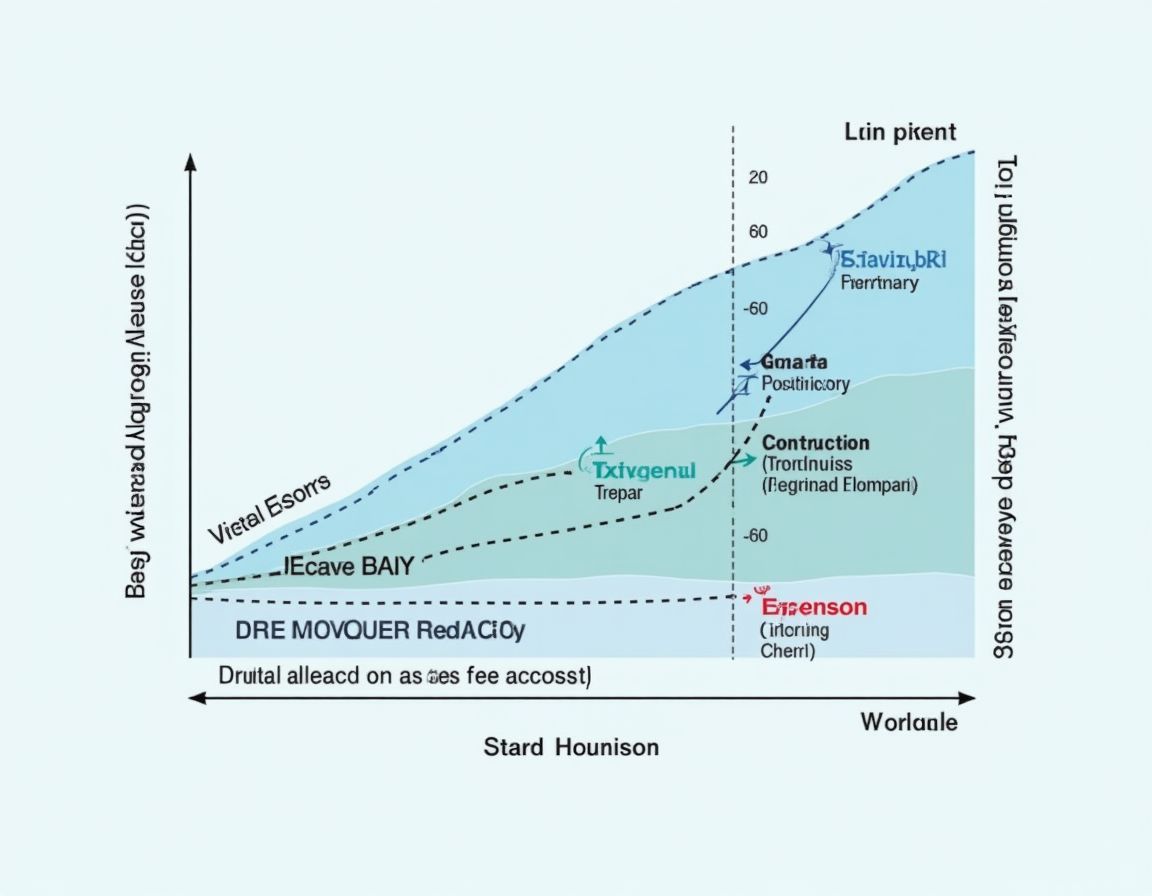

Understanding Market Cycles

Real estate markets move in cycles, and recognizing where your market stands in the cycle is crucial for timing your sale. Selling during peak market conditions can add 10-20% or more to your sale price compared to selling during market downturns. Monitor these key indicators to identify optimal selling windows.

Expansion Phase (Best Time to Sell)

Characterized by rising rents, declining vacancy rates, increasing property values, and strong buyer demand. Cap rates compress as investors compete for properties.

Indicators: Job growth, population increases, new business development, rising rental rates, multiple offers on properties

Peak Phase (Good Time to Sell)

Market reaches maximum values with high prices and strong demand, but growth begins to slow. Smart sellers recognize peak conditions and list before the market turns.

Indicators: Slowing rent growth, increased new construction, rising cap rates, longer time on market

Contraction Phase (Consider Waiting)

Declining rents, rising vacancies, falling property values, and reduced buyer activity. Unless you must sell, waiting for market recovery typically yields better results.

Indicators: Job losses, business closures, rising vacancy rates, declining rents, fewer buyers

Recovery Phase (Opportunity for Value Buyers)

Market begins improving with stabilizing occupancy and modest rent growth. Buyers return but remain cautious. Good time to sell if you bought during contraction.

Indicators: Stabilizing vacancy, modest rent increases, returning buyer confidence, economic improvement

Seasonal Considerations for Apartment Building Sales

While apartment buildings can sell year-round, certain seasons typically see more buyer activity and better pricing. Understanding seasonal patterns is among the practical tips for selling an apartment building that can improve your results with minimal effort.

Spring (March-May)

Peak Season - Highest buyer activity and best pricing

- • Maximum buyer activity

- • Properties show well with landscaping

- • Investors planning for summer acquisitions

- • Tax refunds provide down payment funds

- • Ideal weather for property tours

Summer (June-August)

Good Season - Strong activity but some vacation slowdown

- • Continued strong buyer interest

- • Properties at peak appearance

- • Some slowdown during vacation periods

- • Good for showing outdoor amenities

- • Longer daylight for evening showings

Fall (September-November)

Peak Season - Second-best time with motivated buyers

- • Serious buyers back from summer

- • Investors seeking year-end acquisitions

- • 1031 exchange deadline pressure

- • Pleasant weather for inspections

- • Less competition from new listings

Winter (December-February)

Slow Season - Fewer buyers but less competition

- • Reduced buyer activity

- • Holiday distractions

- • Serious buyers only (less competition)

- • Properties may show poorly in cold climates

- • Potential for motivated year-end buyers

Economic Factors to Monitor

Broader economic conditions significantly impact apartment building values and buyer demand. Monitoring these economic indicators helps you identify optimal selling windows and is among the most sophisticated tips for selling an apartment building at peak value.

Interest Rates

Low interest rates increase buyer purchasing power and property values. Consider selling before anticipated rate increases, as rising rates reduce buyer demand and compress values. Monitor Federal Reserve policy and mortgage rate trends.

Employment Trends

Strong job growth drives rental demand and property values. Markets with diverse, growing employment bases attract more buyers and command premium prices. Sell when employment trends are positive and before potential economic slowdowns.

Housing Supply

Limited housing supply increases rental demand and property values. Monitor new construction pipelines - sell before significant new supply hits the market. Markets with constrained supply due to geography or regulations maintain stronger values.

Cap Rate Trends

Declining cap rates indicate increasing property values and strong buyer demand. Sell when cap rates are at or near historic lows. Rising cap rates signal weakening markets and declining values - consider accelerating your sale timeline.

Government Policy

Tax policy changes, zoning regulations, and rent control legislation impact property values. Sell before unfavorable policy changes take effect. Conversely, favorable policy changes like opportunity zones can create selling opportunities.

Personal Timing Considerations

While market timing is important, your personal situation and investment goals should drive the ultimate decision. These personal factors are equally important tips for selling an apartment building at the right time for your circumstances.

Investment Goals Achieved

If you've reached your target return on investment, appreciation goals, or cash flow objectives, it may be time to sell regardless of market conditions. Don't let greed prevent you from realizing excellent returns. Lock in profits and redeploy capital into new opportunities.

Major Capital Needs

If your property requires significant capital expenditures (roof replacement, major systems upgrades, etc.), consider selling before these expenses arise. Buyers will discount heavily for deferred maintenance, so selling before major repairs are needed often yields better net proceeds.

Life Changes

Retirement, health issues, partnership disputes, or other life changes may necessitate selling. While you should still consider market timing, don't let less-than-perfect market conditions prevent necessary sales. Work with professionals to maximize value within your timeline constraints.

Managing the Due Diligence Process

The due diligence period is when most apartment building sales fall apart. Understanding how to manage this critical phase is among the most important tips for selling an apartment building successfully. Proper preparation and responsiveness during due diligence keeps deals on track and prevents buyer remorse or renegotiation attempts.

What Buyers Investigate During Due Diligence

Understanding what buyers examine during due diligence helps you prepare in advance and respond effectively to requests. Buyers typically spend 30-45 days investigating every aspect of your property to verify information and identify potential issues. Being prepared for these inquiries is essential for smooth transactions.

Financial Due Diligence

- • Verification of income and expense statements

- • Review of rent rolls and lease agreements

- • Analysis of historical financial performance

- • Examination of security deposit accounting

- • Review of property tax assessments and appeals

- • Verification of utility expenses and allocations

Physical Due Diligence

- • Comprehensive property inspections

- • Roof, structural, and foundation assessments

- • HVAC, plumbing, and electrical system evaluations

- • Environmental assessments (Phase I/II)

- • Survey and boundary verification

- • ADA compliance review

Legal Due Diligence

- • Title examination and exception review

- • Zoning compliance verification

- • Review of permits and certificates of occupancy

- • Examination of easements and encumbrances

- • Review of any pending litigation

- • Verification of property boundaries

Preparing for Due Diligence Success

Proactive preparation is one of the most effective tips for selling an apartment building smoothly. By anticipating buyer requests and organizing information in advance, you demonstrate professionalism, build buyer confidence, and significantly reduce the risk of deal complications or renegotiations.

Create a Due Diligence Package

Prepare a comprehensive due diligence package before listing your property. This organized collection of documents demonstrates professionalism and allows buyers to move quickly through their review process.

Financial Documents

- • 3 years of profit and loss statements

- • Current year-to-date financials

- • Detailed rent roll with lease terms

- • Historical occupancy reports

- • Utility bills and expense documentation

Property Documents

- • All lease agreements and amendments

- • Property survey and legal description

- • Title insurance policy

- • Recent inspection reports

- • Warranties and service contracts

Operational Documents

- • Vendor contracts and service agreements

- • Property management agreements

- • Insurance policies and claims history

- • Capital improvement records

- • Maintenance logs and schedules

Conduct Pre-Listing Inspections

One of the smartest tips for selling an apartment building is conducting your own inspections before listing. This allows you to identify and address issues proactively rather than being surprised during buyer due diligence.

Benefits of Pre-Listing Inspections

- • Identify issues before buyers discover them

- • Control the narrative around property condition

- • Fix problems at your pace and cost

- • Reduce renegotiation leverage for buyers

- • Demonstrate transparency and build trust

Key Inspections to Consider

- • Comprehensive property inspection

- • Roof certification and assessment

- • Phase I environmental assessment

- • HVAC system evaluation

- • Plumbing and electrical review

Strategic Disclosure

Disclose known issues upfront with your inspection reports. This builds buyer confidence and prevents surprises that could derail your deal. Buyers appreciate transparency and are more likely to accept disclosed issues than discover problems themselves.

Responding to Due Diligence Requests

How you respond to buyer requests during due diligence significantly impacts deal success. Slow responses or incomplete information create doubt and give buyers leverage to renegotiate. These tips for selling an apartment building during due diligence help maintain momentum and buyer confidence throughout the process.

Respond Quickly and Completely

Answer all buyer requests within 24-48 hours. Quick, thorough responses demonstrate professionalism and keep deals moving forward. Delays create doubt and give buyers time to reconsider or find problems. Assign someone to manage due diligence requests full-time if necessary.

Be Transparent and Honest

Never hide problems or provide misleading information. Buyers will discover issues during inspections, and dishonesty destroys trust and often kills deals. If you don't know an answer, say so and commit to finding out. Transparency builds confidence and prevents post-closing liability.

Facilitate Property Access

Make your property easily accessible for inspections while respecting tenant rights. Coordinate inspection schedules efficiently and provide access to all areas including mechanical rooms, roofs, and vacant units. Difficult access frustrates buyers and their inspectors, creating negative impressions.

Address Issues Proactively

When inspections reveal problems, address them immediately. Decide whether to fix issues, offer credits, or adjust the price. Proactive problem-solving prevents buyers from using issues as leverage for major renegotiations. Show willingness to work with buyers while protecting your interests.

Navigating the Closing Process

The closing process is the final hurdle in selling your apartment building. Understanding what happens during closing and how to prepare is among the most practical tips for selling an apartment building successfully. Proper preparation ensures smooth closings and prevents last-minute complications that could delay or derail your sale.

Pre-Closing Preparation

The weeks leading up to closing require careful coordination and preparation. Missing documents, unresolved issues, or poor communication can delay closings and create unnecessary stress. These preparation steps ensure you're ready for a smooth closing day.

Finalize All Documentation

Work with your attorney and title company to ensure all required documents are prepared and reviewed well before closing. Last-minute document issues are a common cause of closing delays.

- • Deed and transfer documents

- • Bill of sale for personal property

- • Lease assignment agreements

- • Tenant estoppel certificates

- • Closing statement and prorations

- • Affidavits and disclosures

Review Closing Statement

Carefully review the closing statement (HUD-1 or settlement statement) several days before closing. Verify all numbers including purchase price, prorations, credits, and fees. Question any items you don't understand or that seem incorrect. Errors caught early are easily fixed; errors discovered at closing cause delays.

Prepare for Property Transfer

Organize all keys, access codes, manuals, warranties, and vendor contact information for transfer to the buyer. Create a comprehensive property transfer package that includes everything the new owner needs to operate the property smoothly from day one.

Understanding Closing Costs and Prorations

Knowing what to expect for closing costs is among the essential tips for selling an apartment building. These costs can total 2-4% of the sale price, so understanding and budgeting for them prevents surprises. Additionally, understanding prorations ensures you receive proper credits for prepaid expenses.

Typical Seller Closing Costs

Real Estate Commission

If using a broker

4-6%

Attorney Fees

Legal representation

$2,000-$5,000

Title Insurance

Owner's policy (if required)

$1,000-$3,000

Transfer Taxes

State and local taxes

0.5-2%

Recording Fees

Document recording

$200-$500

Payoff Fees

Existing loan payoff costs

Varies

Miscellaneous Fees

Courier, wire transfer, etc.

$500-$1,000

Common Prorations and Credits

Property Taxes

Prorated based on closing date. If you've prepaid taxes beyond closing, you receive a credit. If taxes are unpaid, the amount is deducted from your proceeds. Verify tax calculations carefully as errors are common.

Rent Collections

Rent collected for periods after closing belongs to the buyer. If you've collected rent beyond the closing date, you credit the buyer. Conversely, if rent is unpaid, buyers typically assume responsibility for collection.

Security Deposits

All tenant security deposits transfer to the buyer at closing. You must provide detailed accounting and transfer the actual funds. This is not a credit against purchase price but an actual cash transfer.

Utilities and Services

Prepaid utilities, trash service, pest control, and other services are prorated. Provide documentation of prepaid amounts to receive proper credits. Cancel or transfer services effective on closing date.

Operating Expenses

Insurance premiums, management fees, and other operating expenses are prorated to closing date. Prepaid expenses result in credits to you; unpaid expenses are deducted from proceeds.

Final Walkthrough and Closing Day

The final walkthrough and closing day are the last steps in selling your apartment building. Being prepared for these final events is among the most practical tips for selling an apartment building and ensures everything concludes smoothly without last-minute surprises or complications.

Final Walkthrough

Buyers typically conduct a final walkthrough 24-48 hours before closing to verify property condition hasn't changed since their inspections. Ensure the property is clean, all agreed repairs are complete, and nothing has been removed that should convey with the property.

- • Verify all systems are operational

- • Ensure agreed repairs are completed

- • Confirm nothing has been removed

- • Address any last-minute concerns immediately

Closing Day Procedures

Closing typically occurs at the title company or attorney's office. You'll sign numerous documents transferring ownership and receive your proceeds. The process usually takes 1-2 hours. Bring valid identification and be prepared to sign many documents.

- • Review all documents before signing

- • Ask questions about anything unclear

- • Verify wire transfer instructions for proceeds

- • Obtain copies of all signed documents

- • Transfer all keys, codes, and materials to buyer

Post-Closing Tasks

After closing, complete these final tasks to ensure a clean break and avoid post-closing complications or liability.

- • Notify tenants of ownership change in writing

- • Cancel insurance policies effective closing date

- • Forward any mail or tenant payments received

- • Provide any additional information buyer requests

- • Keep copies of all closing documents

- • Consult with tax advisor about reporting requirements

Common Mistakes to Avoid When Selling

Learning from others' mistakes is among the most valuable tips for selling an apartment building successfully. These common errors cost sellers thousands or even hundreds of thousands of dollars in lost profits, delayed sales, or failed transactions. Avoid these pitfalls to maximize your success and minimize stress during the selling process.

Overpricing Your Property

The Mistake: Setting an unrealistic asking price based on emotion, outdated comparables, or wishful thinking rather than current market data and property fundamentals.

The Cost: Overpriced properties sit on the market for months, become stale listings, and ultimately sell for less than they would have if priced correctly initially. You lose negotiating leverage and attract only bargain hunters.

How to Avoid:

- • Obtain professional appraisals or broker opinions of value

- • Analyze recent comparable sales in your market

- • Calculate value using income capitalization method

- • Price competitively to generate multiple offers

- • Be willing to adjust price if market feedback indicates overpricing

Poor Documentation and Record Keeping

The Mistake: Failing to maintain organized, comprehensive records of income, expenses, leases, maintenance, and capital improvements. Providing incomplete or disorganized information to buyers.

The Cost: Buyers lose confidence, question your management competence, and reduce offers to account for uncertainty. Deals fall apart during due diligence when documentation can't support asking price.

How to Avoid:

- • Maintain detailed financial records from day one of ownership

- • Keep all leases, amendments, and tenant correspondence organized

- • Document all capital improvements with receipts and permits

- • Create a comprehensive due diligence package before listing

- • Use property management software to track all information

Neglecting Property Maintenance

The Mistake: Deferring maintenance and repairs in the months or years before selling, thinking you'll save money by letting the buyer handle issues. Presenting a property that looks tired or poorly maintained.

The Cost: Buyers heavily discount for deferred maintenance, often by 2-3 times the actual repair cost. Properties in poor condition attract only value-add investors seeking deep discounts, not premium buyers.

How to Avoid:

- • Maintain property consistently throughout ownership

- • Address critical repairs before listing

- • Invest in curb appeal improvements

- • Clean and paint common areas

- • Fix obvious defects that signal poor management

Hiding Problems or Providing False Information

The Mistake: Concealing known defects, misrepresenting income or expenses, or providing misleading information to make the property appear more attractive than it actually is.

The Cost: Deals collapse when buyers discover deception during due diligence. You face potential lawsuits for fraud or misrepresentation. Your reputation is destroyed, making future transactions difficult.

How to Avoid:

- • Disclose all known defects and issues upfront

- • Provide accurate, verifiable financial information

- • Be transparent about property challenges

- • Work with reputable professionals who value honesty

- • Remember that buyers will discover problems during inspections

Poor Timing and Rushed Sales

The Mistake: Rushing to sell without proper preparation, listing during poor market conditions, or making hasty decisions under pressure. Not allowing adequate time for marketing and buyer competition.

The Cost: Rushed sales result in lower prices, poor terms, and accepting suboptimal offers. You leave money on the table and may regret the decision later.

How to Avoid:

- • Plan your sale 6-12 months in advance when possible

- • Prepare property and documentation before listing

- • Time your sale for optimal market conditions

- • Allow adequate marketing time to generate competition

- • Don't let desperation drive decision-making

Not Using Qualified Professionals

The Mistake: Trying to save money by handling the sale yourself without experienced brokers, attorneys, or advisors. Using inexperienced professionals who lack commercial real estate expertise.

The Cost: Costly mistakes in pricing, marketing, negotiation, legal issues, and tax planning. The money saved on professional fees is dwarfed by the money lost through inexperience and errors.

How to Avoid:

- • Hire experienced commercial real estate brokers

- • Work with attorneys specializing in commercial transactions

- • Consult with CPAs knowledgeable about real estate taxation

- • Use qualified intermediaries for 1031 exchanges

- • Invest in professional photography and marketing materials

Additional Mistakes That Cost Sellers Money

Ignoring Market Feedback

If you're not getting showings or offers, the market is telling you something. Refusing to adjust price or terms based on market feedback results in extended time on market and lower final sale prices.

Emotional Decision Making

Letting emotions drive decisions rather than financial analysis leads to poor choices. Treat the sale as a business transaction, not a personal matter. Make decisions based on data and professional advice.

Inadequate Marketing

Relying on minimal marketing or single channels limits buyer exposure. Comprehensive, multi-channel marketing generates more interest, competition, and better offers. Don't skimp on marketing for million-dollar properties.

Inflexible Negotiation

Being unwilling to negotiate or compromise on any terms kills deals. Successful sellers know when to stand firm and when to be flexible. Focus on your key priorities and be willing to compromise on less important terms.

Ignoring Tax Planning

Failing to plan for tax implications can cost 30-40% of your profits. Consult with tax professionals early to explore strategies like 1031 exchanges, installment sales, or opportunity zone investments.

Accepting First Offer

Jumping at the first offer without proper evaluation or attempting to generate competition often means leaving money on the table. Use first offers as leverage to attract additional buyers and create bidding situations.

Ready to Sell Your Apartment Building?

Now that you've learned these expert tips for selling an apartment building, it's time to take action. We buy apartment buildings for cash and can close on your timeline. Get your free, no-obligation cash offer today and discover how easy selling your property can be.

Whether you're ready to sell now or just exploring your options, our team of experienced professionals is here to help. We understand the complexities of apartment building sales and can guide you through every step of the process.

Why Sell to Us?

All-Cash Offers

No financing contingencies or delays. We have the funds ready to close quickly and provide certainty you can count on.

Fast Closings

Close in as little as 7-14 days or on your preferred timeline. We work around your schedule and can accommodate flexible closing dates.

Buy As-Is

No need for repairs, renovations, or improvements. We buy properties in any condition, saving you time and money on preparations.

No Fees or Commissions

Keep more of your profits. We don't charge commissions or hidden fees. The offer we make is what you receive at closing.

Experienced Team

Our team has decades of combined experience buying apartment buildings. We understand the complexities and can handle any situation professionally.

Hassle-Free Process

We handle all the details and paperwork. You don't need to deal with marketing, showings, or complicated negotiations. Just a simple, straightforward sale.